We have around 24 Life Insurance Companies and as of now, all insurance companies offer online term insurance plans. Hence, it is hard to shortlist the BEST among them. This post will help you in shortlisting the Top 5 Best Online Term Insurance Plans in India 2020.

What is Term Life Insurance?

Term Insurance is the type of Life Insurance. If death occurs of the policyholder during the policy period, then his/her nominee will receive the Sum Assured selected. If policyholder survives till the end of the policy period, then he/she will not receive any maturity amount.

This is the reason, these policies cost you very less and cover a large amount of life risk. This is the PURE LIFE INSURANCE. Hence, anyone who has financial dependents must buy this product immediately.

However, nowadays there are so many variants in Term Life Insurance. For example, the return of premium, Term Life Insurance up to 100 years of age, a variety of riders and a variety of claim payable options.

But instead of complicating your dependents, buy a simple plain term life insurance. Why you complicate your dependents when you are buying this is that this product’s benefit will come into picture when you are not here.

What are the advantages of online Term Insurance Plans?

Nowadays all Life Insurance companies offer you online term insurance plans. The advantages of online term plans are as below.

- It is convenient to buy as with the click of a button you can buy it.

- As there will not be any middlemen involved, the price is cheap than offline term insurance plans.

- You fill the proposal form on your own. Hence, an error of margin is LESS.

- Undue influence by agents is not there.

- Along with the discount of DIRECT purchase, if you buy through online then now life insurance companies will give you 8% on your FIRST YEAR PREMIUM. This is to promote cashless online transactions.

Top 5 Best Online Term Insurance Plans in India 2020

Now let us shortlist the Top 5 Best Online Term Insurance Plans in India 2020. How I selected the Top 5 Best Online Term Insurance Plans in India 2020?

- How old are the companies

- Claim Settlement Ratio

- Premium Cost

- Plan Features.

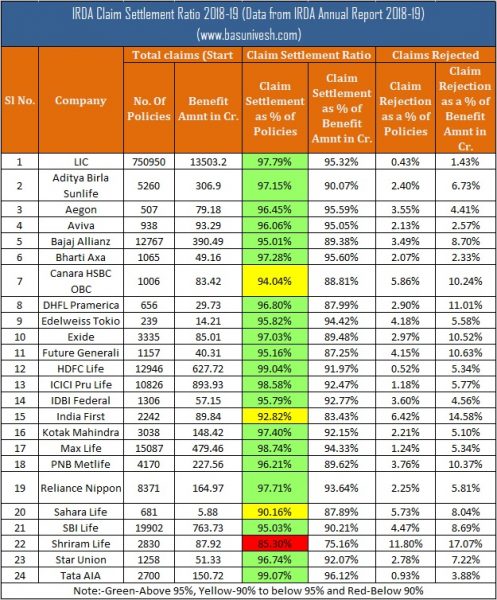

IRDA Claim Settlement Ratio for 2018-19

Among total 24 Life Insurance Companies, around 20 companies are in GREEN (Claim Settlement Ratio above 95%). Earlier it was 11 companies. Only three companies are in yellow (claim settlement ratio above 90% but below 95%) and one is in red (Less than 90%). As usual, LIC tops the list. But don’t feel happy. Let us see the claim amount settled by individual companies to arrive at best companies.

Top 5 Best Online Term Insurance Plans in India 2020

Based on the IRDA Claim Settlement Ratio 2018-19, which are the Top and Best Life Insurance Company in 2020? I select a few based on the above data. You may differ in my view and come up with a different set of ideas. But these are my choices.

- LIC

- HDFC Standard Life

- ICICI Pru Life

- Max Life

- Aegon

Premium Cost of Term Insurance Plans

Example of a person whose age is 30 years, Term of Plan as 30 years, Non-Smoker and healthy, Sum Assured Rs.1 Cr and yearly premium payment. I selected plain vanilla products without any riders or add-on features.

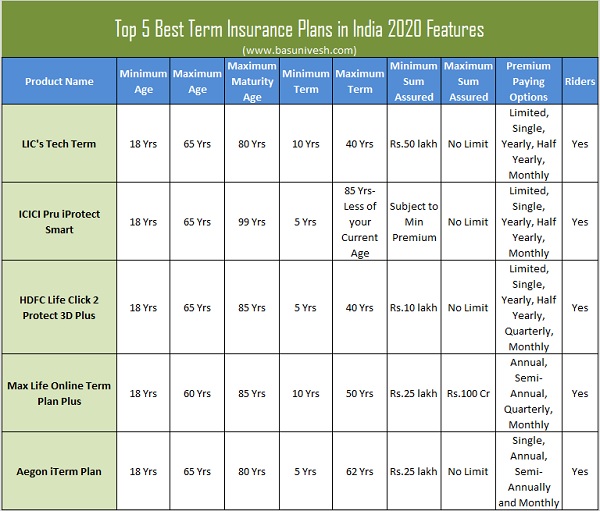

Now let us look at the plan features and decide which are the Top 5 Best Term Insurance Plans in India 2020.

Few points to consider while buying term insurance

Never rely on Claim Settlement Ratio

Claim Settlement Ratio is raw data. This data will not give you enough picture of what type of products the insurance companies settled. Hence, relying too much on this single data and selecting a product is not a good idea.

# Quantum of Life Cover

Ideally one must have at least 15-20 times of your yearly income. This is the basic calculation.

# Fill the data properly

Sharing data especially materialistic information must be accurate. If you are unable to understand anything, then immediately contact Life Insurer for the help. Understand the questions and fill only when you know what you are filling.

# Never allow someone to take over your decision

Never budge on the decision which is against your wish. If you are fully comfortable, then only go ahead and buy.

# Term of the policy

Ideally, it should be up to your working life. Because you retire when you are financially free. Hence, Life Insurance is not required during your retirement age.

# Splitting of Term Insurance

There are few who are apprehensive of relying on a single insurer. Hence, they try to split among few. But in reality, there is no logic in splitting. What is the guarantee that the all insurer will accept or reject the claim?

# Stay away from riders

Never combine Life Insurance with General Insurance requirement. You will get better-featured covers from general insurers regarding accidental and critical illness covers. Hence, simply avoid riders.

# Never heed the aggregators choice

Nowadays there are so many online aggregators. You may not know that they act exactly like insurance agents. Hence, never rely on their claim. Do your own research. If you are satisfied, then only go ahead and buy.

# Know about Sec.45 of Insurance Act

After the recent clarification about Sec.45 of Insurance Act, the customer became king. It states “No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e. from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later.”

# Review your life insurance cover

Buying Life Insurance of Rs.1 Cr or Rs.3 Cr is not a one-time affair. You must review your life insurance requirement at least once in the 5 years. If required, then you must increase the sum assured.

# Be cautious with premium payment

In case of term insurance, you have to be very cautious when it comes to premium payment. It is always better to opt for yearly premium payment and also if possible make it automated by the way of ECS. If policy lapses due to your negligence, then you have to undergo medical tests and all kinds of stuff once again. If there are any health issues, then the insurer may reject to renew the policy.

# Never go for Telemedical Examination

Recently one of my blog readers pointed that few Life Insurance companies insisting just Telemedical Examination by questioning about your health details in the phone (Refer-Can I buy Term Life Insurance with Telemedical Verification?).

It may be the easiest process for you and for life insurance companies. However, I feel suspicious of such kind of medical examination. Because in future insurance companies may find 100000 reasons to reject the claim on health ground.

Instead, I suggest you to go for medical examination. This will really clear the dust or doubt in your mind about future claim settlement.