wealth Management

What is Zeker International?

“Delivering Financial Synergies”

We have tie-up with our top wealth management team in Dubai Focuses to Achieve Sustainable, Transferable Growth Value to it’s Clients who are Stakeholders in Businesses, High Networth Individuals & Family Offices over the medium to long term period.

What is our Philosophy?

Holistic & Comprehensive Insights to Businesses & Portfolios

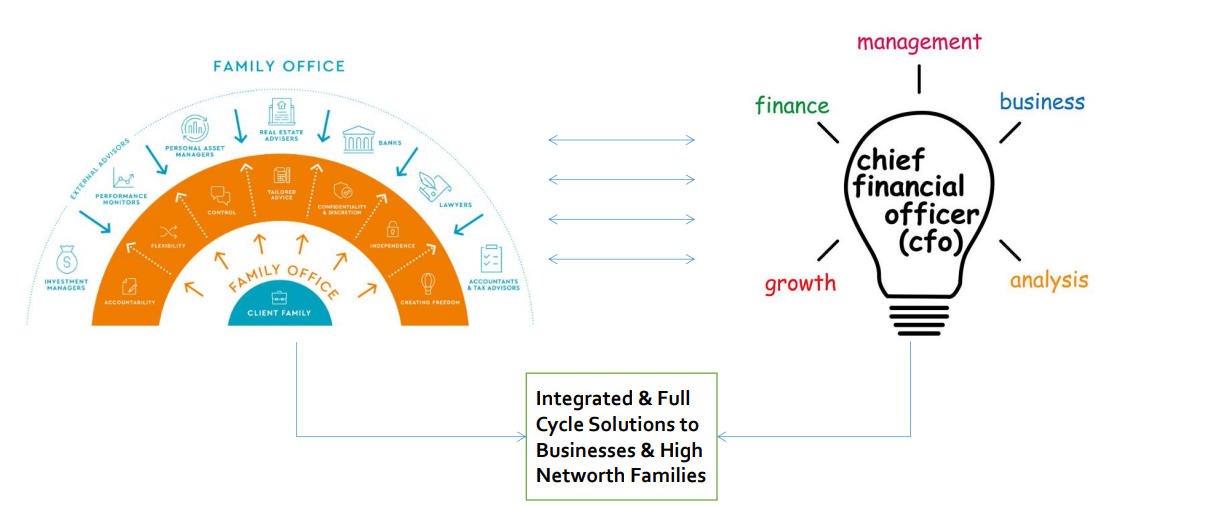

We at Zeker International Synergize with multiple Stakeholders, Product & Service Providers, Technology Consultants&arange of other professionals to deliver Sustainable, Growth Focused Financial, Operational &Investment Objectivesfor our Clients.

What is our Process?

Zeker International stands ready to provide Strategy & Consulting Support to Businesses & High Networth Individuals. Webring functional & industry expertise, deep insights, actionable recommendations, commitment and know-howtounlock value across your organizations.

What is Our Offering?

Our Services range from providing Fractional CFO Services to Businesses as well as Advisory &TransactionServicestoKey Promoters & High Networth Individuals. With Technology being an Integral part of Businesses today, Zeker International Offers High Quality Technology Solutions to Clients with an objective of Financial Control & TransformingOperations.

Why work with Zeker International?

Zeker International provides services to clients, with fresh local and global perspectives, customized services and innovative approaches to meet their challenges and advisory needs.

Wealth Planning

WEALTH PLANNING & INTERNATIONAL FIXED INCOME STRUCTURE

Bespoke Investment Portfolios

constructed and aligned to your

investment criteria & objectives.

We will gather information to thoroughly ‘know our client’s situation’, views on investing and objectives, before conducting research and recommendations. We always provide a compliance audited Suitability Report to each client, with supporting and relevant documentation.

Wealth Planning – Looking after accumulated wealth is one of the most important aspects of financial planning. It always requires a bespoke wealth management solution designed to meet your needs precisely. We

do this by carefully understanding your long term and short term needs and objectives.

The process of wealth management is about controlling investment risk, reducing tax exposure and ensuring that solutions are flexible and adaptable for any changes in the future. Importantly our wholly

client-centric approach means you will always be in control of your

solution.

Depending on your specific needs we will manage your money in one

of two ways; either via our carefully constructed diversified portfolios that have exposure to the broadest range of asset classes. We work with the client to adjust the composition of their portfolio when appropriate. Alternatively, we will provide a dedicated investment manager who will work with you at even closer level.

Structured Products

- A structured product is a pre-packed investment strategy that manages risk by exposing the investor to a mix of equity indices, a basket of stocks, currencies, interest rates and commodities.

- The investor’s required capital protection is one element which effectively determine the structured product. Another is the derivative which links the investment with an underlying index, a currency or a basket of securities.

- A well-diversified portfolio will benefit highly from the introduction of structured products as they can add significant value when they fit within the overall strategy of the investor. Additionally, these products can also work to enable access to different assets classes in private client portfolios.

International Pension Planning

Pensions to higher your income in

retirement.

Saving for retirement is something that most of us put off because of other commitments. But the reality is that the sooner you start paying into a pension the higher your income in retirement is likely to be.

If you’re working you’re usually building up the right to a basic State Pension – and possibly an additional State Pension – but these may not be enough to give you the standard of living you want. So you’ll need another source of income as well.

This section will help you to understand the benefits of using a pension to save for your retirement, what pensions are available, how they work and how to start saving for your retirement.

What is a pension?

Pensions are long-term investments with special tax rules, for example you get tax relief on contributions. This means that the taxman tops up your contributions so your pension fund is credited with more money than you actually pay in.

You can generally access the money in your pension fund from age 55 and you don’t have to stop working to do this.

Pensions you get from your employer and pensions you start yourself have certain differences. Make sure you understand what’s available to

you and how they work.

Retirement plans, in simple terms, can be defined as those plans that guarantee fixed income after your retirement. They aid in creating a

retirement corpus. This corpus is then invested to generate

post-retirement money flow, thus creating a financial cushion and helping in risk mitigation. The money is rolled out in the form of

monthly pension. All in all, these policies help the insurer in achieving the financial goals of long term nature.

Accelerating Your Growth on Investments

Come and see us so we can tell you more about what we can offer you!

OFFSHORE SAVINGS PLAN

A flexible offshore regular savings plan combining choice with quality global

funds to help international investors build wealth for the future.

The benefits of having an offshore savings plan – As an expat, it’s important to find ways to save money for your future and protect your

assets both in your new country and native territory.

Invest your assets

Offshore Savings Plans allow clients to choose from a range of

investments, and the process of investing is usually straightforward,

requiring little to no involvement. By investing your funds into an offshore Savings Plans you can quickly develop an investment portfolio

that makes the most of your assets, reducing the level of risk and helping you generate healthy returns. This can be used to fund children’s education, retirement planning and home purchase etc. with

long to medium term goals.

LARGE VALUE ASSET PROTECTION

Large Value Asset Protection, Ultra HNI’s for transfer of wealth to the next generation.

Protection is just as important for high net worth individuals as it is for those who rely heavily on their income, High Net Worth Individuals can setup large value asset protection which can be used to transfer wealth to the next generation in case of death.

Many High Net Worth Individuals have agreed that they often had large monthly outgoings

— such as school fees and multiple mortgages

— and the retention of their current standard of living was of high importance to them.

Income protection is very important for this type of client especially where the outgoings came primarily from the breadwinner’s income.

For that purpose, asset income protection is very important for those on a high income. If something happened to the main person who brings in income, the family can be left in a sticky situation if all the other assets are illiquid.”

Many HNI individuals are asset rich, with the main source of liquidity perhaps coming from a high income. High Income and Asset Rich High Net-Worth Individuals need to protect their income and their assets via

high value life insurance contracts.